24th December

2022

Saving for retirement is extremely important. People are living longer and leading more active lives in retirement. As a result, it is more important than ever for one to think about where their income will come from when they retire. As people develop through their lifetime, they have an expectation that a time will come when they will be able to retire. For some people, like those in government employment, the State pension is sufficient to provide a basic level of income. Others may have an opportunity to accumulate wealth without using pension schemes – perhaps through their business ventures or other assets. But most people will want to supplement what they have with some form of some form of long-term savings schemes. Many employers also take the view that, while their employees are working, they should be building up an entitlement to a pension when they retire. But that is confined to the formal sector, which accounts for just about 10% of the workforce. For the balance majority, it is important for individuals to take control of their retirement planning and make decisions accordingly. It is often not appreciated enough that contributing to a pension arrangement can help one build up an extremely valuable asset.

Are Indians financially ready for retiring from work?

In this context, a survey was conducted by Sambodhi and PinBox Solutions have collaborated to produce a survey on digital and financial inclusion. This survey was conducted by telephone, covering 7924 urban respondents and 4243 rural respondents. This was a pan-India survey. In urban areas, the sample was spread amongst relatively upper-middle and high-income earners (35%), relatively middle and lower middle-income earners (34%), and relatively low-income earners and economically weaker sections (31%). In rural areas, the sample covered relatively affluent earners, including medium and large farmers (38%), relatively middle-income earners (39%), and relatively poor earners, including wage labourers (23%). Further, the urban sample covered only earners. Permanent government employees eligible for pension were excluded. HNIs and very poor earners without phone access are likely to be under-represented. Similarly in rural areas, only earners were covered and permanent government employees eligible for pension were excluded. Very large farmers and extremely poor earners without phone access are likely to be under-represented.

One part of this survey looked at whether or not Indians are preparing for a life after retirement by starting to save during their working lives, whether they understand the importance of savings early, and whether there still persist an expectation that it is their children who will look after them in their old age.

Are people saving for retirement?

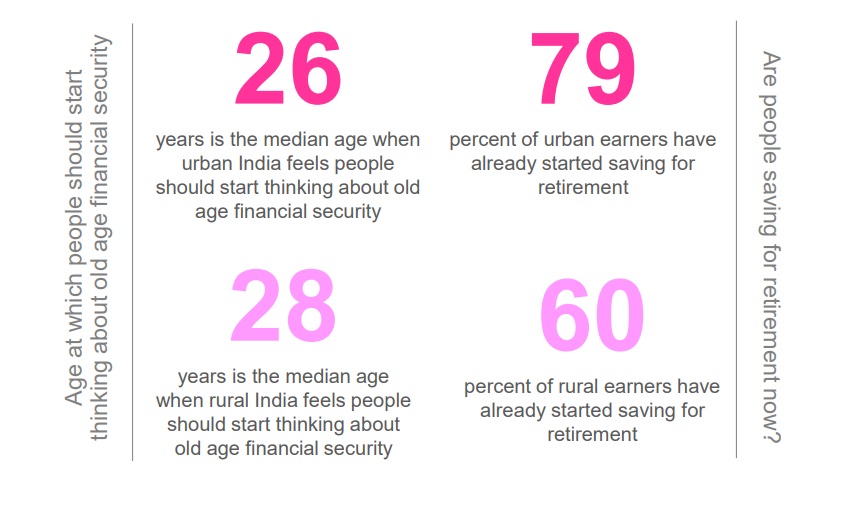

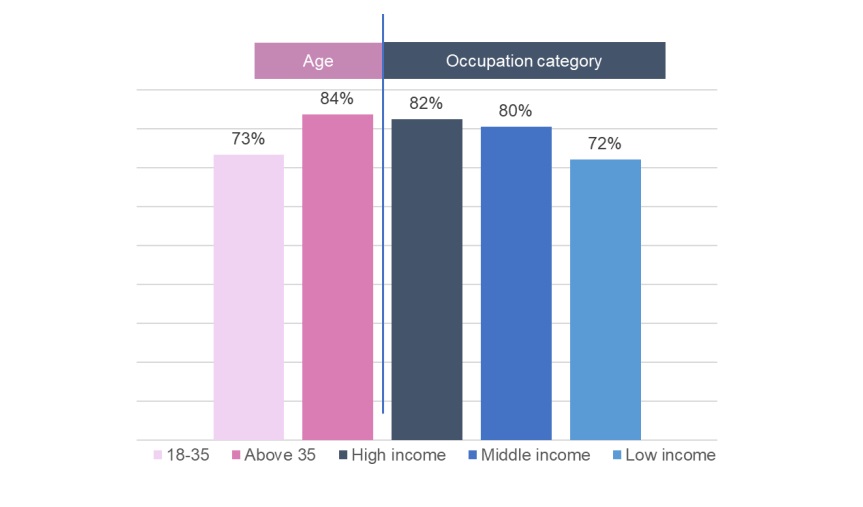

While most earners across urban and rural areas tend to believe that retirement savings should commence towards the middle or late twenties, this is not wholly reflective of their actions. In reality, less than 80% of urban residents and 60% of rural residents are presently saving for their old age..

In urban areas, those above 35 have a greater propensity to save for old age than those who are younger. This distinction is not present in rural India. Unlike in urban areas, in rural India, it is the poor who tend to set aside money for the future whenever they can, possibly because of their uncertainty of steady income.

Proportion of urban residents who have started putting aside some savings for old age

Proportion of rural residents who have started putting aside some savings for old age

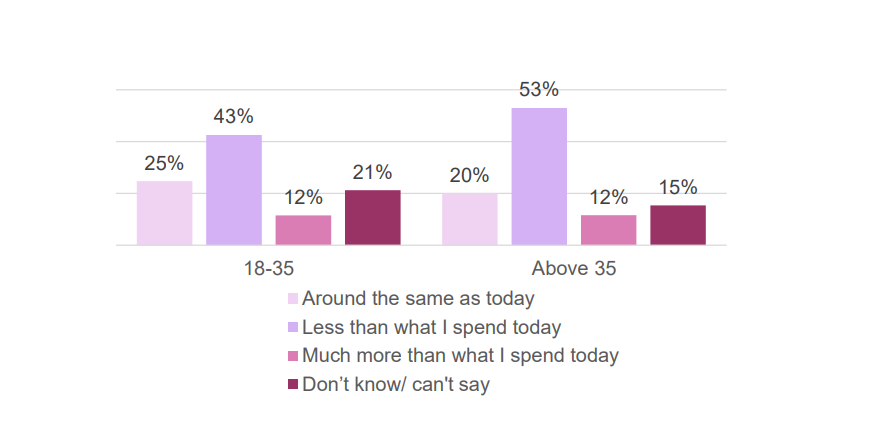

Perception about cost-of-living post retirement from active work

Most urban earners, irrespective of age, tend to believe that their post-retirement expenditure will be lower than what they are spending today. While to a lesser extent this is also true for rural citizens, the exception is that a much higher proportion in rural India are convinced (and perhaps rightly so) that their expenses could increase considerable by the time they retire from work.

Perception of expenditure after retirement as compared to today: Urban India

Perception of expenditure after retirement as compared to today: Rural India

Perceptions of old age financial security

Proportion who expect that their children will take care of them in their old age

High income | Middle income | Low income | ||||

18-35 | 35 & above | 18-35 | 35 & above | 18-35 | 35 & above | |

Urban | 49% | 57% | 49% | 56% | 57% | 66% |

Rural | 28% | 57% | 44% | 56% | 35% | 45% |

Universally, higher share of the older age group tends to believe that their children would take care of them in their old age; but this sentiment is not reflected in the view held by the younger earners, more so from those in the higher income bracket. It is also interesting to note that the dependency factor (on the next of kin) seems to be the highest at the relatively lower end of the income spectrum, especially in urban areas.

Proportion of Indians who are confident that there would be adequate accumulation to support oneself in old age

|

High income |

Middle income |

Low income |

||||

|

18-35 |

35 & above |

18-35 |

35 & above |

18-35 |

35 & above |

|

|

Urban |

65% |

77% |

64% |

73% |

53% |

58% |

|

Rural |

57% |

59% |

48% |

56% |

30% |

32% |